MAXIMUM RETIREMENT ALLOWANCE

At retirement a member may elect to receive the maximum

retirement allowance, which is the largest monetary benefit allowable. Payments

are made throughout your lifetime and cease upon your death.

OPTIONS

An option is a benefit you may elect to provide to a

beneficiary. In doing so, you agree to accept a reduced retirement allowance

during your lifetime. The option cost is based on the option selected, your age

and, the age of your beneficiary(ies) at the time of your retirement. All

calculations are done by the Chief Actuary of the City of New York.

NOTE: There are three options available to members of Tier

II/ Article IIA. Once an option is finalized it cannot be changed (except for

Option 4, Lump Sum). Options do not apply to the Variable Supplement Fund.

Option 2

100% Joint and Survivor—You receive a reduced monthly

lifetime allowance. This option allows the named beneficiary to receive for

life, upon the death of the retiree, the same pension allowance. You can name

only one beneficiary, and you may not change your beneficiary once designated.

Option 3

50% Joint and Survivor—You receive a reduced monthly

lifetime allowance. This option allows the named beneficiary to receive for

life, upon the death of the retiree, 50% of your reduced pension allowance.

You can name only one beneficiary, and you may not change

your beneficiary once designated.

OPTION 4

Lump Sum — You receive a reduced annual pension allowance

for life with the provision that, upon your death, your beneficiary(ies) will

receive a limited lump sum payment specified by you at the time you chose this

option. You may name more than one beneficiary and you may change your

beneficiary(ies) at any time. The lump sum payment may be subject to Federal

tax.

Annuity — You receive a reduced annual pension allowance for

life with the provision that upon your death, your beneficiary will receive an

annual annuity in a specified amount. You can name only one beneficiary and may

not change your beneficiary once designated.

POPUP

OPTION MODIFICATION

Under this option modification, if the named beneficiary

predeceases the retiree, the retirement allowance reverts back to the maximum

retirement allowance. The PopUp may only be applied to Option Nos. 2, 3, and 4

Annuity.

There is an extra cost for this option.

PARTIAL PAYMENTS

After you have filed for retirement, you will not begin

receiving your full monthly retirement allowance until your retirement

allowance is certified (finalized) by the Chief Actuary of the City of New

York. In the interim, you will receive a partial monthly retirement allowance

of approximately ninety percent (90%) of your final estimated retirement allowance.

Once your retirement allowance is certified (finalized), by

the Chief Actuary of the City of New York you will begin receiving your full

monthly retirement checks. Any retroactive adjustments will be included in your

first full monthly retirement check.

WHERE YOUR CHECKS MAY BE SENT

Your pension check will be sent directly to your home unless

you make arrangements with the Pension Fund to mail your check to your bank, or

arrange to have your pension check deposited automatically with your bank by

way of Electronic Funds Transfer (EFT). Change of address forms and EFT forms

are available at the Police

Pension Fund and on our website (www.nyc.gov/nycppf in the

Forms area).

OPTION SELECTION

Prior to finalization you will be notified of the breakdown

of the cost of the various options, if requested during the retirement process.

Once a election has been made, either for an option or for the maximum pension

benefit, your pension can be finalized.

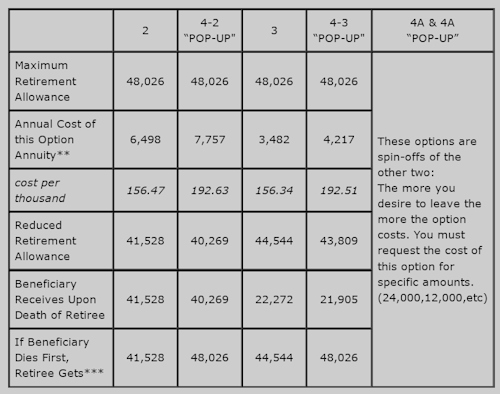

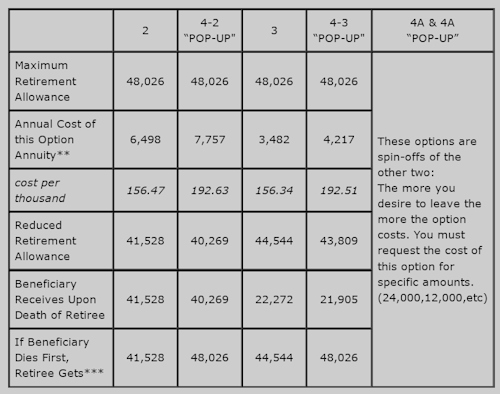

Example of Option Costs for Service Retiree

Maximum Retirement Allowance: $48,026.00

No Option – Maximum Retirement Allowance

Retiree: Male Age 48

Beneficiary: Female Age 45

OPTIONS

One Half